Adjustable Rate Mortgage is fixed for the first seven years. This product has a 30-year amortization and requires 84 monthly payments of $3,537, followed by 276 monthly payments of $3,449. With an ARM loan, the rate is variable and may increase or decrease every 6 months after the initial fixed rate period based on changes to the index.

The monthly payments shown do not incldue amounts for taxes and insurance premiums, so the actual payment obligation may be greater. Rates shown assume standard mortgage qualifications, underwriting requirements, and Automatic Payment discount. For adjustable-rate mortgages, the discount is applicable only during the initial fixed-rate period. All terms and conditions applicable to the checking or savings account apply, including fees and minimum opening deposits. Example based on refinance of owner-occupied, one unit, single family residence in Los Angeles, California with a loan amount of $800,000, 80% loan-to-value, and minimum 740 FICO score.

These rates are intended for informational purposes and are not an offer to extend consumer credit. The 30-Year Fixed Mortgage provides for fixed, fully amortizing principal and interest payments for the life of the loan. The monthly payments shown do not include amounts for taxes and insurance premiums, so the actual payment obligation may be greater. Example based on refinance of owner-occupied, one unit, single family residence in Los Angeles, California with a loan amount of $250,000, 80% loan-to-value, and minimum 740 FICO score.

The 15-Year Fixed Mortgage provides for fixed, fully amortizing principal and interest payments for the life of the loan. Chart data is for illustrative purposes only and is subject to change without notice. Advertised rate, points and APR are based on a set of loan assumptions .

Chart accuracy is not guaranteed and products may not be available for your situation. Monthly payments shown include principal and interest only, and , any required mortgage insurance. Any other fees such as property tax and homeowners insurance are not included and will result in a higher actual monthly payment. Advertised loans assume escrow accounts unless you request otherwise and the loan program and applicable law allows.

Should you choose to waive escrows, your rate, costs and/or APR may increase. Select the About ARM rates link for important information, including estimated payments and rate adjustments. If you have an adjustable rate mortgage and are concerned that your interest rate and monthly payment might increase, refinancing to a fixed rate mortgage can provide a stable monthly payment. People who plan to stay in their homes for 7 years or longer tend to prefer fixed rate mortgages. Alternatively, if you know you will only be in your home for a short time, refinancing to an ARM could provide monthly savings and additional cash flow. It's best to talk with your loan office to determine the right approach for your situation.

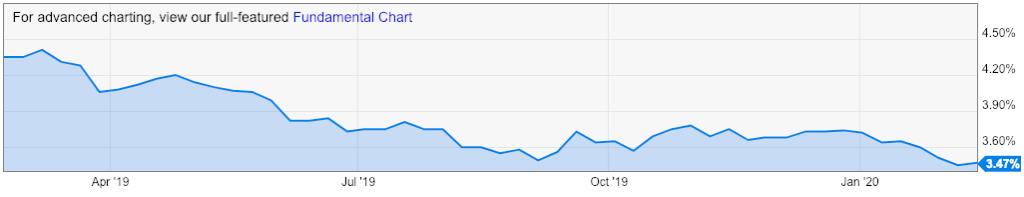

You should consider refinancing your home loan if your current mortgage rate exceeds today's mortgage rates by more than one percentage point. Mortgage refinance fees and closing costs would cut into your savings. You also have to consider whether your credit score would qualify you for today's best refinance rates. Bankrate's mortgage calculator can help you estimate your monthly mortgage payment based on a variety of factors that you choose. You can also factor in your credit score range, ZIP code and HOA fees to give you a more precise payment estimate.

This information is being provided for informational purposes only and is neither a loan commitment nor a guarantee of any interest rate. If you choose to apply for a mortgage loan, you will need to complete our standard application. Our loan programs are subject to change or discontinuation at any time without notice.

Refinancing to reduce total monthly payments may lengthen repayment term or increase total interest expense. Annual Percentage Rate and rate posted are indications only, are subject to change without notice and qualification is subject to credit, underwriting and property approval. Your actual rate and/or points may be different as many factors go into providing you with a mortgage loan. If the Borrower resides in CT, a Liberty Bank checking account is required, otherwise add .25% to the rate. The minimum credit score is 740, an escrow account is required and the rate lock period is 60 days. The mortgage refinance rate we may be able to offer is personal to you.

Your interest rate is affected by the type of refinance loan you want, your credit score, your income and finances, as well as the current mortgage market environment. Freedom Mortgage may be able to offer you a refinance rate that is lower - or higher - than the rate you see advertised by other lenders. Freedom Mortgage may be able to offer you a refinance rate that is lower – or higher – than the rate you see advertised by other lenders.

To determine whether it makes sense for you to pay discount points, you should compare the cost of the discount points to the monthly payments savings created by the lower interest rate. Divide the total cost of the discount points by the savings in each monthly payment. This calculation provides the number of payments you'll make before you actually begin to save money by paying discount points. Rates listed are for primary residence in single family home with 25% equity and borrower credit score of 740. Example monthly payments quoted include principal and interest (P&I) only. Actual payments may be higher if they include taxes and insurance.

Make mortgage payments more predictableIf you have an adjustable rate mortgage, you can refinance your home loan to a fixed rate mortgage and make your monthly payments more predictable. With an adjustable rate mortgage, your interest rate and monthly payments can change every year. With a fixed rate mortgage, your interest rate and monthly payments stay the same. At 2.750%, 30-year mortgage refinance rates are at their lowest level since Feb. 1, 2021. Homeowners looking to lower their interest rates and costs, yet maintain the lowest possible payment, may find 30-year refinance rates particularly appealing.

Meanwhile, 10-year refinance rates afford significant savings opportunities to homeowners who can swing a larger monthly mortgage payment. The average mortgage refinance rate across all terms is just 2.344% — the lowest it's been since August 6. A fixed-rate mortgage has a set interest rate for the life of the loan. With this type of loan, your mortgage rate will never change.

And if interest rates drop to below your current rate, you can refinance to a lower rate. Bankrate's rate tables are updated every business day and contain up-to-date interest rates, APRs, upfront fees and monthly payments for the amount you choose. Utilize these tables to familiarize yourself with the mortgage rates that are currently available, then compare them to decide which option best suits your financial needs. Keep in mind that these are average rates for comparison shopping. Your exact rate will depend on multiple factors, including your credit score, the size of your loan, the location of your house and the term of your mortgage.

When finding current mortgage rates, the first step is to decide what type of mortgage best suits your goals and budget. Most borrowers opt for 30-year mortgages, but that's not the only choice. Typically, 15-year mortgages have lower rates but larger monthly payments than the more popular 30-year mortgage. Adjustable-rate mortgages usually have lower rates to begin with, but the downside is that you're not locked into that rate, so it can change over the life of your loan. Chart data is for illustrative purposes only, is based upon state loan assumptions and is subject to change without notice.

Accuracy is not guaranteed and products may not be available for your situation. Estimated monthly payment does not include taxes and insurance which will result in a higher monthly payment. For borrowers with less than 20% equity, mortgage insurance may be needed which could increase the monthly payment and APR. There are many reasons you may consider refinancing your home. Perhaps you want to reduce the interest rate and lower your monthly mortgage payment, or shorten the mortgage loan term and pay it off sooner. Maybe you want to tap into your home's equity to pay for a large purchase or consolidate debt.

Whatever your goal, Old National offers two different refinance options to meet your specific needs. Refinancing your mortgage can help you in a number of ways. You also might want to refinance to cash out some of your home equity and pay for home renovations or other expenses. The length of your loan's repayment term will also impact your refinance rate.

Shorter term loans have lower rates than longer repayment terms, all else being equal. Ideally, your new refinance loan won't be adding years onto your mortgage, but you can also pay off your mortgage more quickly with a shorter loan term. The downside is that shorter repayment terms will increase your monthly payment, so you'll need to be able to fit a bigger mortgage payment into your budget.

Conforming ARM Loans - Conforming rates are for loan amounts not exceeding $548,250 ($822,375 in Alaska and Hawaii). Adjustable-rate mortgage loans and rates are subject to change during the loan term. Annual Percentage Rate calculation is based on estimates included in the table above with borrower-paid finance charges of 0.862% of the base loan amount, plus origination fees if applicable. If the borrower-equity is less than 20%, mortgage insurance may be required, which could increase the monthly payment and the APR. If you obtained your current fixed-rate mortgage when interest rates were high, you may be able to save a significant amount in both your monthly payments and over the life of the loan. You may be surprised to learn just how much even a relatively small decrease in your interest rate can save you thousands of dollars over the life of the loan.

A Cash-Out Refinance is a mortgage refinance that allows you to access equity in your home. And instead of adding another monthly payment to your list, you'll only have to make one — your regular mortgage payment. The current average interest rate for a 30-year refinance is 3.01%, an increase of 4 basis points from what we saw one week ago. (A basis point is equivalent to 0.01%.) Refinancing to a 30-year fixed loan from a shorter loan term can lower your monthly payments. Because of this, a 30-year refinance can be a good idea if you're having trouble making your monthly payments.

In exchange for the lower monthly payments though, rates for a 30-year refinance will typically be higher than 15-year and 10-year refinance rates. Your actual rate may be higher or lower than those shown based on information relating to these factors as determined after you apply. Nearly all types of refinance loans fall under the "rate and term" category, which is simply when either the rate or repayment term on your mortgage is changed.

Typically, you're replacing your existing loan with one that has a more favorable interest rate or terms. A longer loan term will have smaller monthly payments, but you'll pay more interest over the life of the loan. A shorter term loan will have a lower interest rate, but a higher monthly payment. With these loans, you don't have to pay the closing costs upfront, but you could see a higher monthly payment. Lenders cover the cost of the refinancing by charging a higher interest rate or rolling the fees into the total loan amount. For example, if you are thinking about a mortgage refinance which will save you $100 a month and has $1,500 in closing costs, it will take you 15 months to "break even" and begin to save money.

This is the reason real estate professionals often recommend you do not refinance your mortgage when you are planning to sell your house soon. That's because the savings from a refinance might be minimal if you only live in the house a short time before you sell. You can use our mortgage refinance calculator to help you estimate your potential savings.

Another type of refinance is a "cash-in" refinance, where you can pay down your loan as part of the refinance to get a smaller monthly payment. Increasing your equity, or decreasing your principal balance relative to the value of your house, could also help you drop private mortgage insurance payments. The interest rate is the cost of borrowing the money, and it is advertised as a percentage of the loan. APR stands for annual percentage rate, and it includes the interest rate plus other fees associated with the mortgage. So the APR will provide you with a better idea of the total cost of financing the loan. You may find lenders offering the same interest rate and monthly payments, but if one is charging higher upfront fees, then the APR will be higher.

While mortgage rates have risen from the record lows of late 2020 and early 2021, they remain at historically low levels. That means millions of homeowners still could save by refinancing. It's also possible to tap into your home equity to pay for home renovations. Or, if you want to pay down your mortgage more quickly, you can shorten your term to 20, 15 or even 10 years.

And because home values have risen sharply, it's possible that a refinance could free you from paying for private mortgage insurance. Discount points help homebuyers reduce their monthly mortgage payments and interest rates. A discount point is most often paid before the start of the loan period, usually during the closing process. Each discount point typically lowers in interest rate by 0.25 percent. For example, one point would lower a mortgage rate of 3 percent to 2.75 percent.

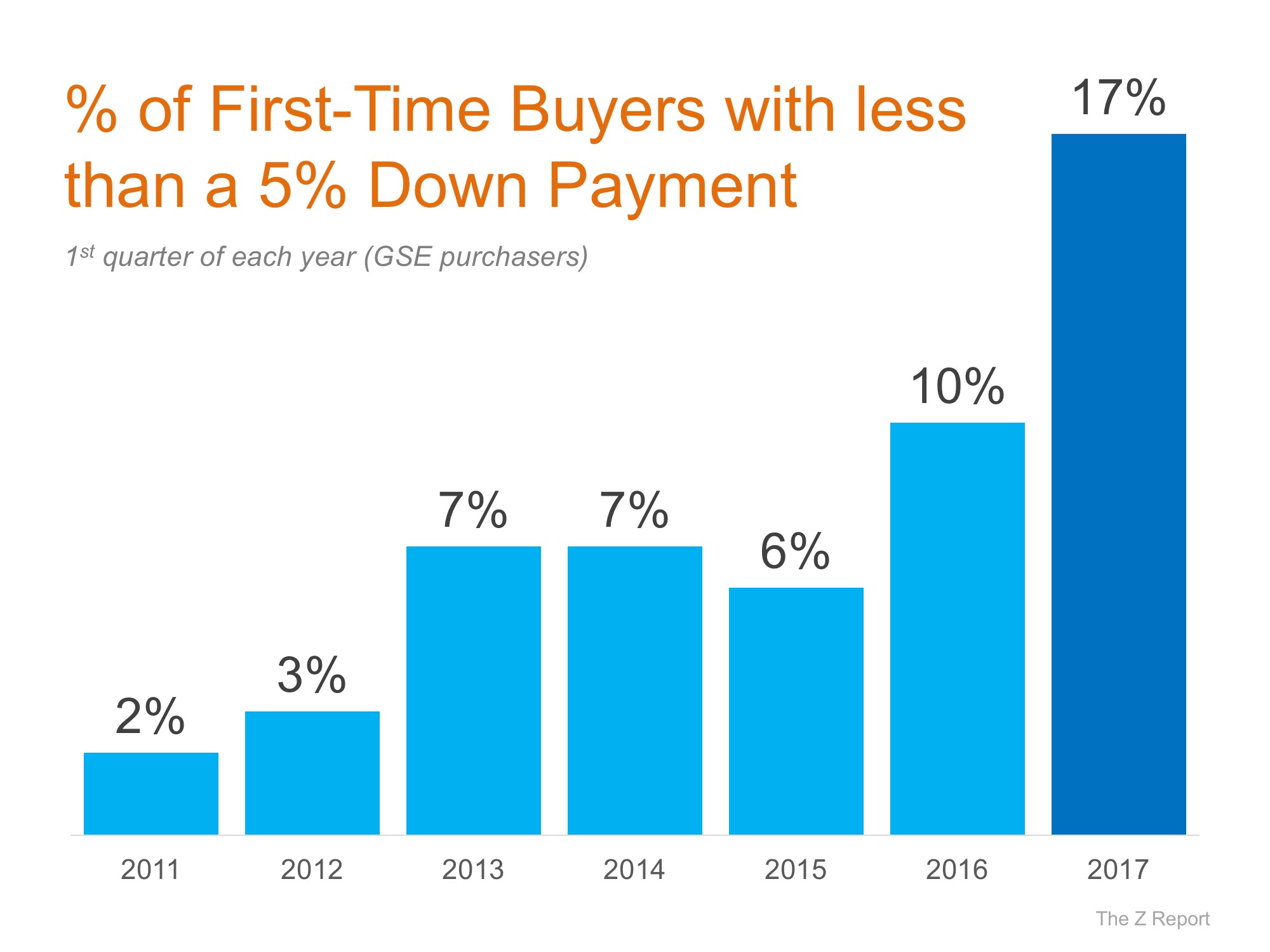

If you put down less than 20% of the purchase price when you first purchased your home, or have an FHA loan, you most likely have mortgage insurance as part of your monthly payment. Depending on the equity now in the property, mortgage insurance can be removed and save you money every month. Check with a loan officer to see if you're eligible to remove your mortgage insurance payment.

An adjustable rate mortgage is a loan with an interest rate that fluctuates based on a publically-available interest rate index . Many adjustable rate mortgage loans have a fixed interest rate period, typically 3, 5, 7, or 10 years. After the fixed rate period has ended, your interest rate can go up or down depending on the interest rate index in effect at that time. Use our mortgage refinance calculator to estimate how much you might save by lowering your interest rate, changing your loan term, and more.

By refinancing, the total finance charges you pay may be higher over the life of the loan. Rates and program information are deemed reliable but not guaranteed. Rates on this page are based on the purchase of a single-family, single-unit, detached, primary residence located in Richmond, VA . Rates also assume a 30 day lock for purchase and 90 day lock for refinance, and are subject to change without prior written notice. All rates are subject to length of lock, pricing adjustments for credit score, loan-to-value, property location and additional factors based on loan program. And don't forget about fees and closing costs, which can add up.

Generally, you'll want a high credit score, low credit utilization ratio, and a history of making consistent and on-time payments in order to get the best interest rates. To get your personalized refinance rates, you'll need to speak with a mortgage professional, as the rates you qualify for may differ from the rates advertised online. Also remember to account for potential fees and closing costs.