Capital One offers various ways to move money electronically for the purpose of paying bills, making purchases and managing your accounts. Such services include, ATM/debit cards, electronic check conversion, phone transfers, online bill payment and online banking external funds transfer. When using these services, we ask that you monitor your account and alert us of any unauthorized transactions. When using or enrolling with Zelle® within your financial institution's mobile app or online banking service, your bank or credit union will assist you with any issues you may be experiencing.

For further assistance, please reach out directly to your financial institution at the number on the back of your debit card. We offer various ways to move money electronically for the purpose of paying bills, making purchases and managing your accounts. Read more about EFT under theResourcessection on this page.

Trade credit invoicing can make accrual accounting more complex. If a public company offers trade credits it must book the revenue and expenses associated with the sale at the time of the transaction. When trade credit invoicing is involved, companies do not immediately receive cash assets to cover expenses. Therefore, companies must account for the assets as accounts receivable on their balance sheet.

Yes, you can send money to almost anyone with a bank account in the U.S. using an email address or U.S. mobile number. Note that a U.S. mobile phone number or email address can only be enrolled and active with one financial institution at a time. Our convenient alternative to an app lets you bank easily and securely. Use the mobile website to pay bills, send money, transfer funds, view your transaction history and find an ATM or branch. Get all of the banking features you need as close as your smartphone. Transferring money directly to the bank from Paytm is instant and free of cost using Paytm app.

Yes, any Paytm user can make a bank transfer anytime and anywhere in less than a minute. You can link any bank account using Paytm's UPI services and no KYC is needed. Moreover, you also get a Cashback of Rs. 50 on your first bank transfer with Paytm. To make money transfer process fast & trouble-free, you can link your account with Paytm in just a few simple steps. Next, you just have to enter the details of the account holder, precisely IFSC code and account number & you are all set to make a bank transfer at 0% charges. To receive money to more than one account you will need to enroll a unique U.S. mobile number or email address per account.

At least one or more accounts must be with a participating financial institution. Zelle® does not support sending or receiving money between non-participant financial institutions. If the person you sent money to has already enrolled with Zelle, the money is sent directly to their bank account and cannot be canceled.

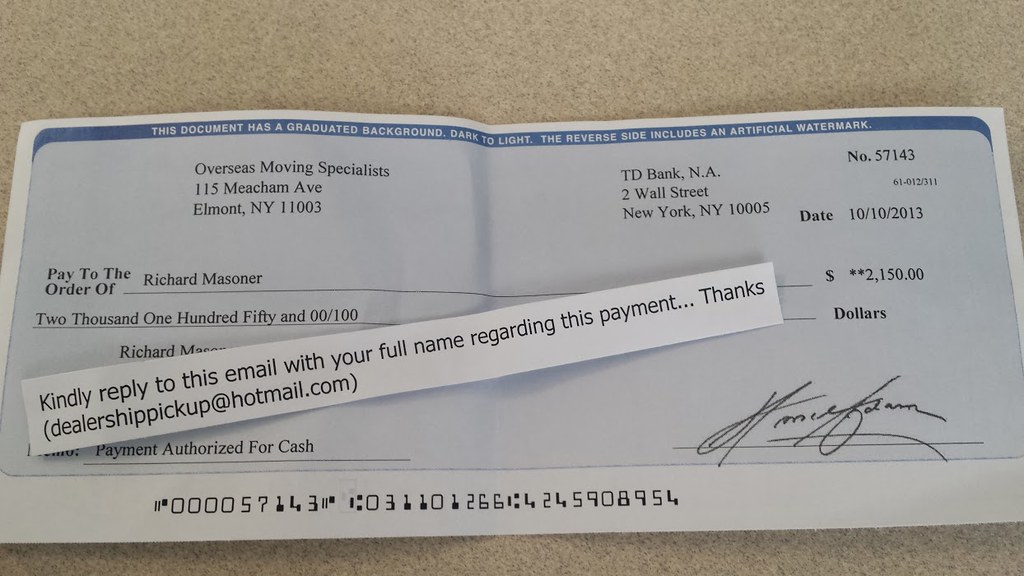

This is why it's important to only send money to people you know and trust, and always ensure you've used the correct email address or U.S. mobile number when sending money. If you sent money to the wrong person, we recommend you contact the recipient and request the money be returned. You can only cancel a payment that has been scheduled but not yet processed. To determine if you can cancel a payment, go to your Activity page and look for a "Cancel" button. Businesses incur costs when they accept a payment from a customer using a credit card, a debit card or a prepaid card. The level of those costs can vary according to the size of the business and which payment method is used.

When you pay a business using certain payment types, for example a credit card, the business incurs costs for processing the payment. These costs are usually paid by the business to its bank. Some businesses include these costs in the price they charge for their goods or services.

Zelle is a fast, safe and easy way to send money, typically in minutes4. Send or request money from almost anyone, no matter where they bank in the U.S5. All you need is their email address or U.S. mobile phone number. You'll receive an automatic alert when payments are sent or received.

If you are enrolled with Zelle® in your financial institution's mobile app or online banking service, their support team will assist you with your lock out. For greater security, when you enroll with Zelle you're required to verify you have control over the email address or U.S. mobile phone number you use to send or receive money with Zelle. If your payment is still pending, we recommend confirming that the person you sent money to has enrolled with Zelle, and that you entered the correct email address or U.S. mobile phone number.

If you're waiting to receive money, you should check to see if you've received a payment notification via email or text message. If you haven't received a payment notification, we recommend following up with the sender to confirm they entered the correct email address or phone number. Don't access personal accounts on unsecured Wi-Fi networks and pass on making any purchases until you have a private connection to help prevent credit card fraud. When using public or shared computers , be aware of your surroundings, including people who could look at your computer screen. Do not select the "remember me" feature for your username and password.

The primary difference is that riders will not need to buy passes in advance. You can earn-as-you-go by adding money to your PRONTO account. Every time you tap to board a vehicle, the appropriate one-way fare is deducted from your balance. A rider will never be charged more than a Day Pass in a given calendar day, regardless of how many trips/taps they make. Likewise, a rider will never be charged more than a Month Pass regardless of the number of trips/taps in a calendar month.

You will be able to track their progress toward a Day or Month Pass on your PRONTO app or online account. If you're enrolled with Zelle® through your bank or credit union's banking app or online banking, your financial institution will be able to assist with deactivating your Zelle® profile. Your financial institution's customer support team can help.

You may enroll only one debit card within the Zelle® app to send and receive money. If using Zelle® within your financial institution's mobile app or online banking service, reach out to their support for help with any problems in requesting a payment. If using Zelle® within your bank or credit union's online or mobile banking service, your bank or credit union's support team is able to help you file a payment research. If you don't know the person, or you aren't sure whether you'll get what you paid for , you shouldn't use Zelle to make a payment.

These transactions are potentially high-risk (just like sending cash to a person you don't know is high-risk). Zelle should only be used to send money to friends, family or others you trust. If you send money to someone who isn't enrolled with Zelle, they'll receive a notification prompting them to enroll. After enrollment, the money will move directly into your recipient's account, typically within minutes.

Once their first payment completes, your recipient will be able to receive future payments faster, typically within minutes2. Your name, financial institution name and email address or U.S. mobile phone number you enrolled is shared with Zelle (no sensitive account details are shared - those stay with BECU). BECU then directs the payment into your account, all while keeping your sensitive account details private. If you link the WhatsApp desktop app to your phone, you can send and receive video calls on your computer.

If you use the Capital One app, you can use mobile app verification to verify your identity and keep your account secure. Mobile app verification uses your sign-in credentials and your phone to help ensure that you – and only you – can access your Capital One account. Capital One uses several security features to help protect your accounts from unauthorized access. The protection of your account and identity is important to us and we continue to strive to enhance our security to protect you against fraudsters. If a fraudster happens to intercept this code, they won't be able to access your funds.

Apple Pay also doesn't store your credit card information on your device or in its cloud service. Make sure you always have a pass loaded to your account by setting up Autorenew. Your payments will go through six days before the start of the month. Simply cancel Autorenew before the 20th day of the month to stop the following month's pass from loading.

At the start of the month, you need to tap your card as part of a regular trip to activate the load onto your PRESTO card. Until you have done so, your monthly pass is not valid and does not count as paid fare. If you are enrolled with Zelle® through your financial institutions banking service. Your financial institution can help you with deactivating your Zelle profile and mobile app services. When sending money with Zelle®, if the recipient has not enrolled the U.S. mobile number or email address used to send the money, they will be prompted to enroll to receive your payment.

The recipient has up to 14 days to enroll to receive the money before it expires. During this time, the money will remain pending and you will have the option to cancel the payment. Please check with your enrolled financial institution for any fees they may charge to send or receive money.

The Zelle® app is free to download from your App Store or Google Play. There are no fees when using the Zelle® app to send or receive money. When you send a payment today, your account is debited immediately. If you schedule a transaction to go standard delivery, those payments are debited on the day they are scheduled to process. It's also important that you keep a record of how much money you spend from your account so you know how much money you have available to spend. Zelle is already available within the BECU mobile banking app and Online Banking.

Just check the app or sign in online and follow a few simple steps to enroll with Zelle today. We recommend you enroll before someone sends you money - this will help you get your first payment faster. Zelle is a fast, easy way to send and receive money from friends, family and other people you know and trust1, typically within minutes2, using their email address or U.S. mobile phone number. Companies offering trade credits also usually offer discounts, which means they can receive less than the accounts receivable balance.

Both defaults and discounts can require the need for accounts receivable write-offs from defaults or write-downs from discounts. These are considered liabilities a company must expense. A B2B trade credit can help a business to obtain, manufacture, and sell goods before ever having to pay for them. This allows businesses to receive a revenue stream that can retroactively cover costs of goods sold. Walmart is one of the biggest utilizers of trade credit, seeking to pay retroactively for inventory sold in their stores.

International business deals also involve trade credit terms. In general, if trade credit is offered to a buyer it typically always provides an advantage for a company's cash flow. Verizon also offers a more robust paid anti-robocall tool called Call Filter Plus, which can block unwanted calls. Most Verizon phones come preloaded with the Call Filter app, which is necessary to activate Call Filter Plus. If your phone isn't preloaded with the app, it's available for download at the app store. A business is not able to by-pass the new ban by introducing what is in effect a payment surcharge but calling it something else.

A cybercriminal will use social engineering to pretend to be your friend or a family member asking for money. They can approach you on social networks and in messengers. Often they would either ask you to pay for something via a dummy online store, send money to a fake charity, or transfer the money to them directly .

If you're an Apple enthusiast, you probably already know what Apple Pay is. If you choose the earn-as-you-go method, you will load money into your account, and then the appropriate one-way fare will be deducted on each trip. You can add money to your PRONTO account in the amount of a Day Pass . The appropriate one-way fare will be deducted every time you boards a vehicle and tap your card/scan the mobile barcode. In a single day, no more than the value of a Day Pass will be deducted from the account, no matter how many rides are taken that day.

Phishing scams are attempts by scammers to trick you into giving out your personal information such as your bank account numbers, passwords and credit card numbers. Scammers use all kinds of sneaky approaches to steal your personal details. Once obtained, they can use your identity to commit fraudulent activities such as using your credit card or opening a bank account. The text messages ask you to tap on a link to download or access something.

However, the message is fake, there is no delivery, voicemail, or photos uploaded and the app is actually malicious software called Flubot. If your activity statement is due later than the regular due date then your quarterly STP report is still due by your later activity statement due date. If you've provided any personal or financial information or downloaded any software in response to a scam, you should also consider contacting your bank.

They'll be able to provide advice on securing your account from any fraudulent activity. Ask you to download security updates, tap links or go to websites, which can be used to download malicious software to your device to gain your personal or financial details. Refund will be processed back to the original payment method, which in this case is Amazon Pay balance. If a transaction was partially paid through Credit card, then the refund will be processed to credit card and Amazon Pay balance respectively. You can use Paytm for many different things such as online recharge, shopping, pay fees, bills and a lot more thing.

You will need to at least one of your bank account to your Paytm account and then you can enjoy India's fastest online transactions and payment service. Paytm stands for Pay through mobile and it is India's largest mobile payments and commerce platform. It lets you transfer money instantly to anyone at zero cost using the Paytm Wallet. You can make cashless transactions at several places like taxi and autos, petrol pumps, grocery shops, restaurants, coffee shops, multiplexes, and many more. You can also use Paytm to pay for online recharges, utility bill payments, book movie or travel tickets among other things on the Paytm app or website. Do you need to borrow money to make auto repairs, consolidate credit card debt, or pay your mortgage?