As a leading customer service provider, TD Bank Canada Trust offers a broad range of financial products and services to personal and small business customers. As part of the TD Bank Financial Group, with headquarters located in Toronto and offices around the world, TD Bank Canada Trust administers anywhere, anytime banking solutions through telephone and Internet banking. We feature more than 2,600 ATMs and a network of approximately 1,100 branches across Canada. When you make a payment, your financial institution's online banking app or website will display the date your payment was made.

Payments are usually received by the CRA within 5 business days. To avoid fees and interest, please make sure you pay on time. The case illustrates the role of performance measurement and analytics in translating TD-Canada Trust's service model of comfortable banking into operational terms.

Chris Armstrong, executive vice president and chief marketing officer, was now faced with the task of defining the comfortable banking model and consistently delivering on these promises. Provides a full range of financial products and services to personal and small business customers. As a leading customer services provider, TD Canada Trust offers anywhere, anytime banking solutions through telephone and internet banking, more than 2,600 ABMs and a network of approximately 1,100 branches across Canada. You can pay your personal and business taxes to the Canada Revenue Agency through your financial institution's online banking app or website. Most financial institutions also let you set up a payment to be made on a future date.

TD offers clients the possibility of opening a personal foreign currency account in pounds sterling. The monthly fee to operate this account is £1.50. Customers who maintain a balance of at least £500 at the end of each month pay no monthly fees whatsoever.

You get unlimited transactions with no fees, but you can't bank via ATM machine, EasyWeb, or debit payment. TD Canada Trust is the commercial banking operation of the Toronto-Dominion Bank in Canada. They serve over 14 million customers and provide a full range of financial products and services. You can bank with TD Canada Trust through its retail branch network, mobile app which is accessible 24/7, telephone, Internet banking and 'TD Green Machine' automated banking machines.

Customers looking for a personal account in euro can opt for a foreign currency account in exchange for a monthly fee of EUR 1.75. As above, they can make as many transactions as they wish without paying any additional service charges. However, they can't use ATM machines, EasyWeb Internet Banking, or debit payments to manage their transactions.

Horrible customer service experience and awful financial advice. CSR at the Customer Care department was very unprofessional and provided an advice that damage my credit. TD Canada Trust should provide better training to the Customer Care department and prioritizing client's goals as the main tool to direction any financial advice or complaint.

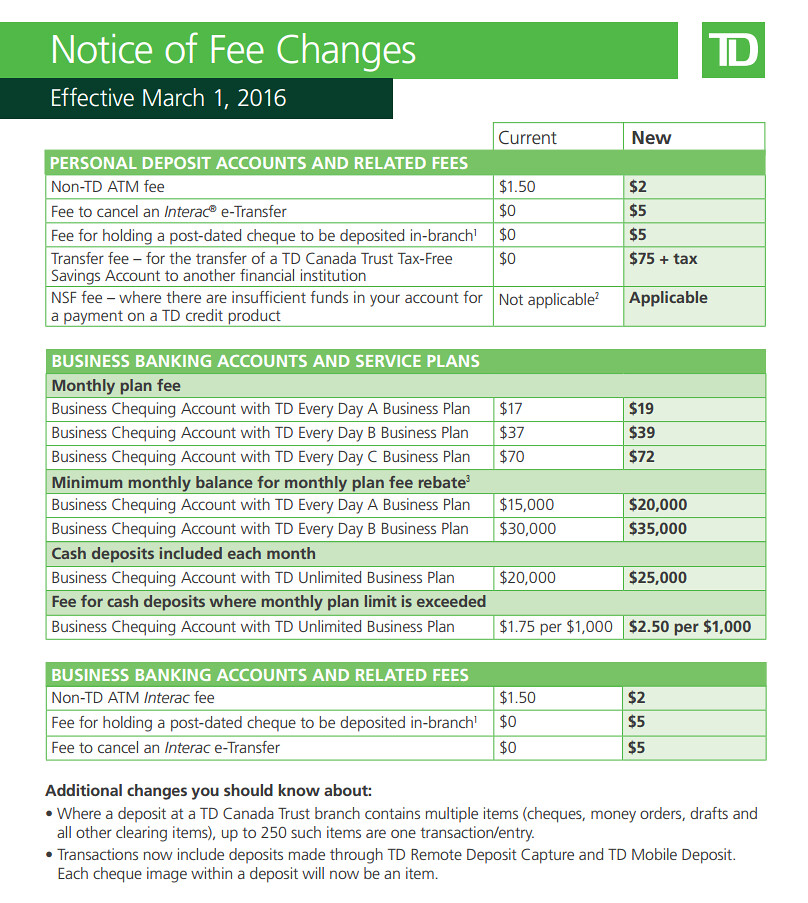

Also, TD bank is one of the most expensive banks in relation to banking fees. If you are looking to pay a lot of money in fees every year. But after everything that happened to me I'm switching to a different financial institution. After more than 12 years of being with this bank. Worst customer service experience ever and in middle of a COVID-19 crisis.

TD Canada Trust offers a full range of products and financial services to individuals and small businesses. Leader in customer service, TD Canada Trust offers anywhere, anytime, banking solutions by phone, Internet, ATM's or through its network of branches in the country. My situation with TD is that they have received a mortgage payout but is still reporting on my credit report with transunion that the mortgage is still owing and it is on deferral.

These financial institution are taking advantage of the COVIT not to update accounts . It is one month and looks like they dont want the money or their staff does not know to do the job. They keep calling my phone to collect mortgage and there is nothing to collect.

TD disapproved my mortgage for new property to have me borrow from private lending which they are financing to make money from private lending. Each month they are updating payment on credit file but TD is still reporting I need to pay monthly mortgage. Dont know how confusing financial people can be.

Another issue id that they want to pay the property tax through mortgage and double charge and tripple charge customers . I would think we have qualified ppl in Canada.How many months or years TD will still have on my credit file with Transunion that the property I sold mortgage is owing and is on deferral and individual resposibility. This is to ensure I don't get or cannot get mortgage for my new property. Question for TD , did you all lend my private lender the money to lend me so I have to pay 13% interest and until that lending period is over and you all drain out all my finances so I will have to go bankrupt and loose my house. Is this how ppl loose their properties and bank take it over. You all are for yourselves to earn hugh salaries and dont know what you are doing.

Get my credit file with transunion straightened out or I will go further. The focus of innovation within TD's mobile experience has been to provide customers with insights that can contribute to their understanding of their financial wellness. TD Canada Trust is TD Bank Financial Group's customer-focused personal and business banking business.

Small business clients are offered foreign currency accounts in several denominations. There's sadly no information on the foreign currency accounts that you can get, besides US dollar ones. Instead you need to visit a branch for details, as their Small Business Foreign Exchange page instructs. Also, there's a minimum balance required to avoid monthly fees for some currencies, and depending on the denomination, there may also be an excess balance fee.The latter means you need to pay a fee, if your balance gets too great. A modern financial service like Wise uses the mid-market rate on all transfers and conversions. You pay a small fee and with it's free to open a borderless multi-currency account, that has no monthly fees either.

There you can manage and send dozens of different currencies all from the same account. Soon you will also be able to get a multi-currency debit card. TD Canada Trust is TD Bank Financial Group's customer-focused personal and small business banking business. TD Canada Trust is TD Bank Group's customer-focused personal and small business banking business. To my amazement, and despite all the marketing from TD about its cross-border banking, it is very hard to get US dollars I deposit in Canada into my US dollar accounts in the States.

And there is no documentation on either TD site to facilitate the process. US Dollar TD Every Day Business Three monthly plans with fees based on the number of transactions, 50 deposit items, and monthly fee rebates for balances starting from US$20,000. US Dollar Basic $1.25 per transaction , $0.22 per deposit item, $2.50 for every $1,000 cash deposit, $5.00 monthly plan fee. First 5 deposit items and transactions are free. Opt for Wise and pay nothing for opening an account. With the borderless account, your business can get its very own local bank details for several regions around the world – so your clients can pay and get paid locally.

Best of all, Transferwise makes it very easy for me to move my USD income into whichever bank and currency I choose. If I want to transfer those US dollars into my USD bank account with TD Bank in the States, so I can pay my US Visa card, no problem! If I want to turn them into Canadian dollars in my TD Canada Trust, no problem! I can convert the money myself, at Transferwise's great rates, and then transfer the money to my Canadian account. It takes a couple of days for the transfer to go through but it's hassle free.

To conclude, TD Trust has quite a diverse offering for personal and business customers looking for foreign currency accounts. But what it all comes down to for a Canadian who wants to bank in a variety of denominations is due diligence. A bit of research can go a long way, and hopefully you'll find the best solution for your particular needs. The interbank rate, also known as the mid-market rate is something you probably want to know about.

It's the rate, that banks use to trade among each other. When money exchange services and banks set their own rates to sell you currency, it can be considered a additional fee. You may get very different rates, with varying levels of markup, from different providers. And should you frequently be exchanging currency or dealing in large sums, it can add up quite quickly to bigger amounts. While it is the standard practice of financial institutions to use a markup on the rate, the downside of this practice is, that you do not know the percentage of markup that's being used.

That percentage is still a cost that the buyer of the currency will take on. And as it varies by who is selling it to you, it would give a better overview of the total fees, if this was disclosed in a more clear way. In today's open world of digital nomads, frequent travellers and global purchasing, multi-currency accounts and similar solutions are sought after, to make cross-border banking easier. If you're thinking about opening a foreign currency account with TD — short for The Toronto-Dominion Bank — then this article is here to give you an overview. A number of Toronto-Dominion customers took to social media Friday to report problems accessing their online banking accounts and issues with the mobile app.

TD Canada Trust is a commercial banking operation of the Toronto-Dominion Bank in Canada. TD Canada Trust offers a range of financial services and products to more than 10 million Canadian customers through more than 1,100 branches and 2,600 ATMs. TD Canada Trust offers bank accounts, credit cards, mortgages and other financial services to both businesses and individuals. Online banking is available both through the website and mobile apps. Sign in to your financial institution's online banking service for businesses.

Sign in to your financial institution's online banking service for individuals. You can deposit or send USD to your TD Trust account using the Foreign Exchange Transfer service either in branch or via EasyWeb (up to US$250,000 or equivalent). You can also send over 25 major currencies by wire transfer or foreign currency bank drafts. Below is the official TD fee schedule for foreign currency accounts. They come with no transaction fees and they offer unlimited transactions. But banking via EasyWeb Internet Banking, ATM machines, and debit payment purchases are out of the question.

TD Canada Trust products and services include investing, insurance, banking and small business. Featuring TD Canada Trust EasyWeb online banking. We make it easy to bank, from personal accounts to investing your money, TD can help with financial products and services. TD also ranks among the world's leading online financial services firms, with more than 14 million active online and mobile customers. TD had CDN$1.7 trillion in assets on January 31, 2021.

The Toronto-Dominion Bank trades under the symbol "TD" on the Toronto and New York Stock Exchanges. Looking for td canada trust easy web online banking login? Find top links for easy and hassle free access to td canada trust easy web online banking login. TD offers a couple of different USD personal accounts. These enable you to convert and shift money across the border when you need it, using online banking or the TD app. TD Canada Trust products and services include investing, mortgages, banking and small business.

Located at 1511 Bayview Avenue, TD Canada Trust products and services include investing, mortgages, banking and small business. In the U.S., TD launched a virtual assistant within the TD U.S. mobile banking app in just three weeks to help support customers. TD has also recently expanded its innovative "TD for Me" push notifications to U.S. app users, which enable customers to receive personalized content, helpful tips, and special offers via their mobile device.

In 2010, TD Canada Trust launched a mobile banking app for iOS, Android and BlackBerry platforms, allowing clients to perform many of the same transactions that are available through EasyWeb online banking. TD customers are able to do online banking through TD's EasyWeb system. EasyWeb allows users to perform transactions, manage bills, update personal information, manage investments, and view banking histories. Our local Credit and Cash Management Relationship Teams ensure you have access to the products, services and support you need to manage your business banking needs. It can take up to 48 hours for that wire transfer to go through. There is also a $23.63 USD wire transfer fee charged to my TD Canada Trust USD account, but that is refunded immediately .

In theory you do step #3 with an online "Visa Direct" transfer to get money from your USD Canada Trust personal account to your USD TD Bank account. According to the TD website the daily limit is $2500 but the TD rep I spoke to said the transfer has to be less than $1k; maybe TD only rebates the fee for lower denomination transfers? These are exactly the kinds of questions where I never get the same answer from two TD reps in a row. Since I'm usually transferring more than $2500 anyhow, I prefer to just call and have them do the the transfer. When it comes to foreign currency accounts, you need to consider the rates at which the bank operates with, the possible markup and the various fees added to your monthly bill to understand all costs associated.

After waiting 6 months finally got a promised refund from a major airline due to cancelled trip. The TD credit card used to book the trip has been closed and TD promised to put the refund in my bank account. I spoke to 4 different TD Visa reps and was given 3 different dates when refund would be processed. Very disappointed and we will be taking our business elsewhere. What you're trying to keep and build upon is the value that you've paid for. So, when we bought Commerce in the U.S. that was a very transformative deal and it was very much like the TD-Canada Trust merger.

Commerce adds very similar service attributes to Canada Trust and our U.S. bank tended to be much more of a traditional regional, commercial player in the U.S. To buy Commerce and integrate its customer ethic was valuable to us. It upped our game from a customer service point of view. So, we wanted to keep all that and expand on it. When you enable Direct Connect, you'll be given the login credentials you need to connect.

Generally, these login details differ from those used for other services like ATM or online banking. TD Canada Trust is one of the biggest banks both in North America and is one of the primary banking institutions in Canada. TD offers a varierty of banking and financial services with the purpose of enriching the lives of their customers, communities and colleagues.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.